Who are the electric car buyers?

E-mobility is on everyone's lips, and retailers are confronted with it more than ever. But who are today’s electric car customers? What motivates them to buy and what stops them from doing so? A persona study by Escalent and a survey by DAT provide further insights.

Who are the electric car buyers?

Some car manufacturers seem to be putting all their eggs in one basket when it comes to e-mobility. Tesla only has electric cars, VW wants to throw itself massively into e-mobility, Mercedes-Benz is following suit, Renault is already well on its way there. In other words: If the e-mobility bet doesn't work out for manufacturers to the extent planned, we'll be facing a billion-dollar grave. It is all the more important to know what motivates today's and tomorrow's customers to buy an electric car and what stops them or causes them to doubt.

The EVForward study attempted to describe six different electric vehicle buyer personas based on its results. Pleasing: 81 percent of new car buyers in Europe are open to battery-powered electric vehicles (BEVs). Surprising: Only 12 percent actually expect to buy a BEV next. This results in a big gap that manufacturers need to close: There is fundamental interest, but the threshold for purchasing is still too high for the vast majority. But what stops interested parties from making a binding purchase? Range, long-term battery life or battery replacement costs, and charging speed top the list of barriers to purchasing an electric car for all buyers. In contrast, the price difference between a new electric car and a conventional gasoline or diesel vehicle is not one of the top five barriers. Only 15 percent of buyers plan to exclusively use public charging infrastructure, and 85 percent do not want to do without the convenience of a charging station at home. It is almost alarming that almost half of all consumers do not know of any public charging stations along their normal route.

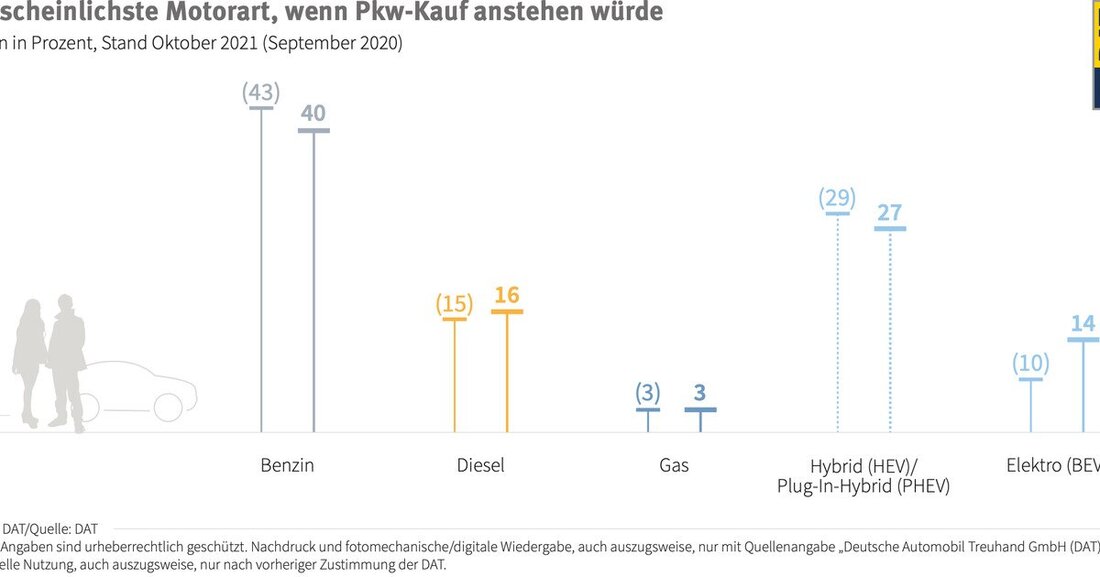

DAT barometer

The DAT barometer conducted a representative survey among 1,062 online participants. A somewhat similar picture emerges: According to this, only 14 percent would currently choose a purely electric car - at least four percent more than in the previous year. Most people today would choose a gasoline car (40 percent) or a hybrid model (27 percent). Pleasing: Preoccupation with the topic of e-mobility has increased by ten percent to 39 percent. However, this does not necessarily lead to higher e-car acceptance: 43 percent would replace their existing main car with an e-car, while 39 percent only want to use it as a second or third car. In addition, the vast majority of those surveyed (78 percent) are critical of the disposal of batteries, and 66 percent fear that car owners will incur additional costs. When asked about the basic option of purchasing or leasing an electric car, 29 percent of all respondents currently prefer leasing. A good two thirds of those surveyed were only very vaguely aware of e-fuels.

Buy or lease?

When it comes to purchasing electric cars, 29 percent prefer a leasing model, 43 percent prefer classic ownership, and 28 percent couldn't decide. One reason for a leasing model can be security in terms of loss of value or costs that arise later. Two thirds fear that they will be asked to pay again for the disposal of an electric car (e.g. after an accident or if it is scrapped due to age). But ecological considerations also play a role when it comes to batteries: 78 percent of car owners are critical of their disposal. They think that there are still too few solutions or concepts for this.

Suche

Suche

Mein Konto

Mein Konto