The transformation must succeed”

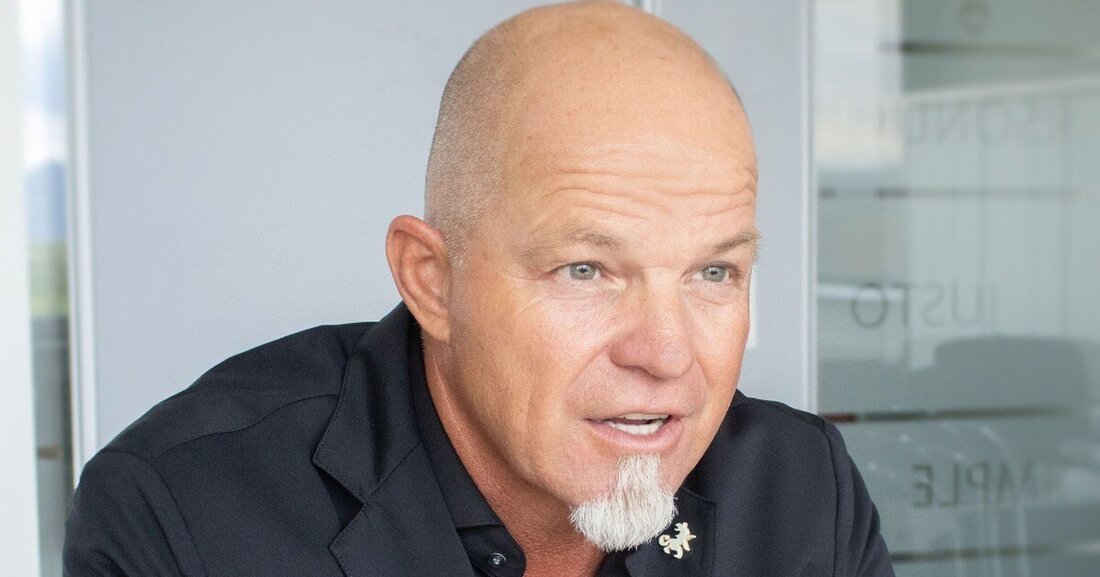

Michael Schwaiger, CCO of Santander Consumer Bank, on the strained new car business and the shift to e-mobility.

The transformation must succeed”

AUTOMOBILE INDUSTRY:Santander has shown steady growth in the automotive business in recent years - is the upward trend still unbroken?

MICHAEL SCHWAIGER: A clear yes to that. So far everything has developed positively, sales in our automotive business totaled 881 million euros in the first half of 2023 - that's an increase of 4.9 percent compared to the previous year.

Do you notice the often reported reluctance to buy new cars due to general inflation?

The situation in the new car business is indeed tense, but so far this has not yet had an impact on our results. After all, many orders from the previous year are still being processed this year, which are only now becoming apparent due to delivery delays. But 2024 will probably be more difficult if you look at the current order intake.

What is the used car business like?

Things are going great there. It is noticeable that many customers are changing their orientation and would rather purchase a used car that is available immediately rather than wait many months for a new vehicle. The lower price certainly also plays a role in this decision.

Keyword financing – variable loan interest rates have risen sharply and have caused many home builders to have repayment difficulties. What proportion do your customers’ variable-interest loans and leasing contracts account for in the car business?

We estimate that two thirds to three quarters of all vehicles in Austria are financed, with the leasing portion accounting for around 60 percent. The proportion of variable-interest loans and leasing contracts in our bank is around 90 percent. Compared to real estate loans, the increase in the rate for a car is not that high, but because everything is becoming more expensive, it is still a significant additional stress factor.

The current trend in new car trading is towards the agency model. Are you afraid that your business with dealer financing will be lost?

The number of our dealer partners is currently 1,888, of which 430 are dealer financing partners. The new agency model expected could lead to corresponding challenges, although the framework conditions and details are not yet completely obvious. At the moment we are not noticing any effects as this development is still very new and is only being used selectively. In general, this development is not a reason for us to worry.

How does the politically mandated change towards electromobility affect your business?

Private car buyers today are not yet 100% convinced of electromobility. Our aim is to make mobility affordable for private customers too. In addition to affordable vehicles, this also requires greatly improved framework conditions such as a dense and fast charging network with transparent tariffs. I drive an electric car myself and can only say: the range is not the problem, but the infrastructure is growing more slowly than the number of electric vehicles on the market and can therefore still be expanded. That's a shame, because with regard to climate change I am of the opinion that we must succeed in the transformation.

Suche

Suche

Mein Konto

Mein Konto