The DAT barometer allows for some optimism

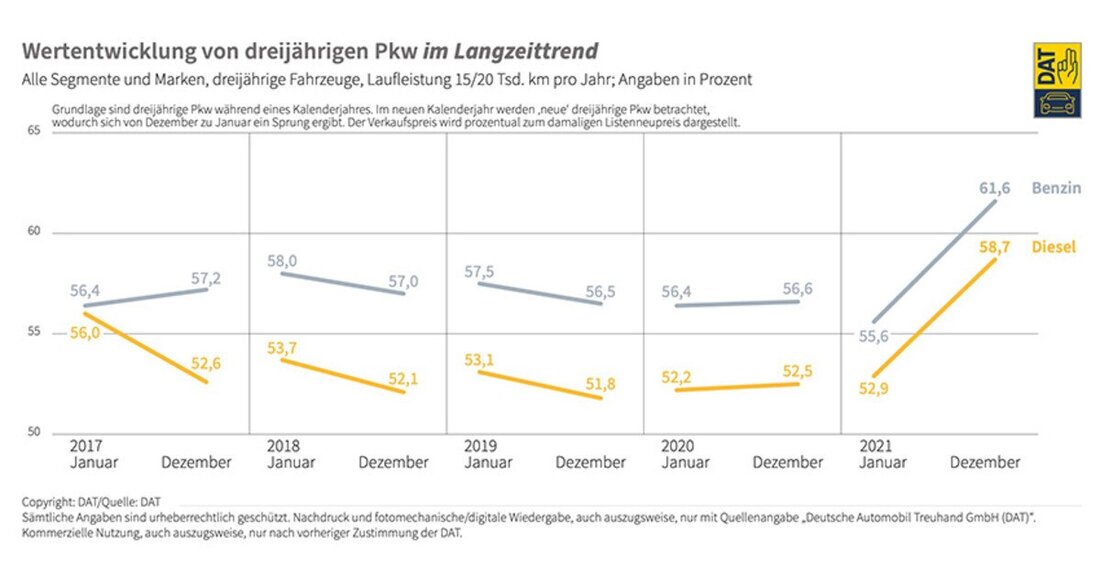

The DAT barometer shows: Petrol and diesel prices are converging again or are developing upwards in parallel.

The DAT barometer allows for some optimism

The car year 2022 will be turbulent: delivery difficulties in the new car market will remain an issue, as will electrification - with all its challenges for car dealers, workshops, end users, infrastructure and the automotive industry. From the perspective of registration numbers and re-registrations, the year 2022 got off to a cautiously positive start. The new registrations are almost therenine percentover the same month last year, the used car market is developing with an increase of just undersix percent(Attention: the DAT barometer refers to Germany). The used car market in particular would be significantly more positive if there were more used cars. This is particularly noticeable in terms of vehicle values, but also in terms of idle days: the values of three-year-old used cars are at record highs, and the shorter time spent on dealer lots continues when it comes to idle times (especially for diesel vehicles).

Looking back at the two Corona years 2020 and 2021, the fluctuations in the new and used car market - due to lockdowns and the associated difficult conditions such as closed registration offices - were very clearly visible. As it currently looks, 2022 will probably not be an easy car year for everyone involved as a transitional year, but cautious optimism is warranted. When analyzing the market, however, particular focus should be placed on the separate consideration of inventory, new registrations and re-registrations (used car market): Especially when it comes to alternative drive types, new registrations - pushed by bonuses and tax advantages - are significantly more electrified than the used car market or the inventory with its around 48 million cars.

A change was already noticeable in trading at the beginning of 2021: for the first time, used diesel engines were once again available for a shorter period of time than petrol engines. In 2019, the service life of diesel engines was significantly longer than that of gasoline engines. In 2020, the situation eased somewhat, and in 2021 and January 2022, used diesel cars were in significantly greater demand than gasoline engines. The reasons for this are varied. The tight supply of diesel cars overall or the high gasoline prices can lead to greater demand for diesel vehicles. Currently, a used diesel car stands for 77 days and a used petrol car for 89 days before it is sold.

After the restart in 2022, retailers were able to sell their used cars again at significantly higher prices. With64.5 percentof the former new list price (three years old) for petrol engines and62.3 percentFor diesels, both values were once again higher than the previous year. The trend of increased prices has already been apparent since the second half of 2021. The situation on the new car market (long delivery times, lack of semiconductors) continues to have an impact on the used car market, and there is also still a shortage of goods due to the lack of new registrations from previous years.

The long-term trend shows that used vehicle values have varied depending on the type of fuel since the diesel crisis. In 2017, values for used diesel and gasoline cars differed by almost five percentage points. A parallel development with this gap could be observed during 2018 and 2019. With the start of the corona pandemic and the high demand for used cars, these two value levels began to align again - while simultaneously rising to record highs. This clearly confirms the trend:The used car market is at a record high.

Suche

Suche

Mein Konto

Mein Konto