New car market hits new low

The crisis on the new car market continues: February saw further declines in sales in Austria.

New car market hits new low

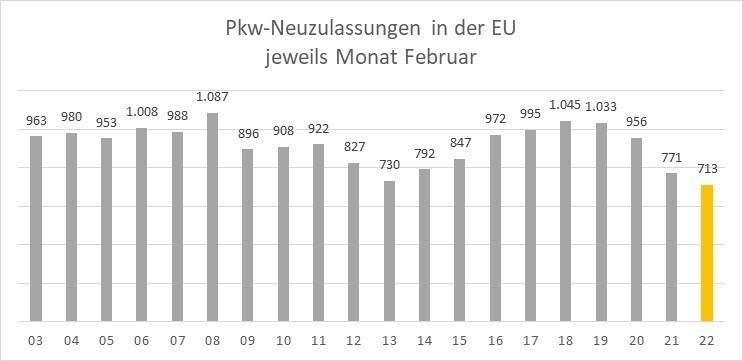

There is no end in sight to the crisis on the new car market: In February, new car registrations in the EU fell by seven percent compared to the same month last year, reaching a new record low. Compared to the pre-pandemic level (February 2019), there is even a decrease of 30 percent.

The larger markets have recently developed differently - depending on how big the decline was in the previous year: While Germany and Spain, for example, each achieved single-digit growth, France, Italy, Poland and Austria recorded double-digit losses. In Austria the decline was 19 percent compared to February 2021 and even 32 percent compared to February 2019.

The chip crisis was the decisive factor in February that prevented a recovery, according to Axel Preiss, Head of Advanced Manufacturing & Mobility at EY: "February was primarily influenced by the ongoing chip crisis; important components have been missing for months, which means fewer new cars are being produced. Now at the end of February, the situation has worsened again due to the Ukraine crisis. This is now also having a massive impact on the supplier industry: Some Austrian suppliers have had to interrupt their production due to unstable supply chains. This further worsens the ability of car manufacturers to deliver. The number of new registrations is likely to continue to fall in the coming months. Even though the industry is currently working hard to find new sources of supply, it will take some time to reorganize supply chains. For car buyers, this means that the availability of new cars will continue to decrease, delivery times will probably continue to rise.

It is also questionable whether the high demand will continue in the coming months, says Preiss: "Rising inflation and record-high fuel prices could have a negative impact on demand for new cars. If the economy weakens - and that is quite possible given the current conditions - this will have an additional negative impact on demand."

The supply chain problems continue to slow down the otherwise booming sales market for electrified new cars, especially for plug-in hybrids: sales of electric cars and plug-in hybrids rose by a total of 36 percent in the five largest markets in Western Europe (Germany, Great Britain, France, Italy and Spain) in February; In the entire previous year, growth was 74 percent. In Austria, new registrations of electrified models rose by just four percent.

The growth momentum for plug-in hybrids was particularly slowed down. In February, sales in the top 5 markets only rose by eleven percent, and in Austria sales even fell by 15 percent. An increase of 67 percent was recorded for purely electric cars in the top 5 markets - in Austria, however, growth was only 15 percent.

"Sales of electric cars and hybrid models could be significantly higher if the industry was able to deliver. There are even more chips installed in electric cars than in conventional cars, so the chip shortage is hitting the segment particularly hard," observes Preiss.

The market share of electrified new cars (electric and plug-in hybrids together) rose from 13.0 to 18.8 percent in the top 5 markets in February compared to the same month last year, and from 14.7 to 18.9 percent in Austria.

In February, Great Britain had the highest market share of electrified new cars among the top five markets in Western Europe at 25.6 percent, followed by Germany (24.9 percent).

When it comes to purely electric cars, Great Britain also led the way with a share of 17.7 percent in February, while plug-in hybrids were most popular in Germany (market share: 10.8%). In Austria, market shares of 13.1 percent (electric cars) and 5.8 percent (plug-in hybrids) were achieved.

Suche

Suche

Mein Konto

Mein Konto