Record result for Santander

Santander Consumer Bank Austria is pleased with record results in 2023.

Record result for Santander

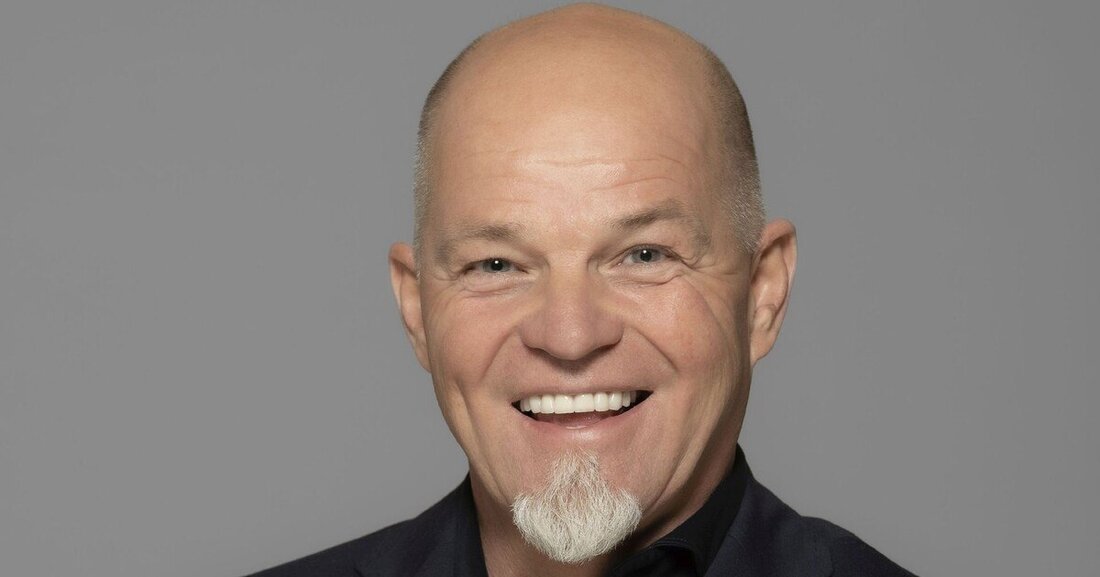

Mike Schwaiger, Chief Commercial Officer of Santander Consumer Bank Austria, beams: “With total assets of 4.98 billion euros, we will once again achieve record results in 2023!” Profit after taxes rose by five percent to 60.6 million euros in the previous year, with the bank benefiting primarily from the ECB's key interest rate increases and the continued growth in new lending business. But internal decisions also contributed significantly to success. “It’s like in football – you need the right people in the right positions – then the team fits and success follows,” says Schwaiger.

The Santander CCO is particularly proud of the automotive division, in which the financing volume increased by 5 percent to 1.76 billion euros compared to 2022. In detail, car loans grew by 4 percent, motorcycle financing by 5 percent and the leasing division by 8 percent. In addition to Kia, Volvo, Ford, Polestar and Fisker, the youngest captive partner in the car sector is the British brand Ineos Automotive, which wants to succeed the off-road vehicle icon Land Rover Defender, which was discontinued in 2016, with the “Grenadier” model. “The brand clearly has cult potential,” Mike Schwaiger is convinced. Things are also cult-like for Santander in the two-wheeler sector, where the latest newcomer, Piaggio, has won the manufacturer of the scooter legend Vespa as a partner. Also in the Santander motorcycle portfolio: The brands Yamaha, Triumph, KTM, CFMOTO, Harley Davidson, Husqvarna, GasGas and MV Agusta. With a total of 76,500 financed vehicles with an average loan amount of 23,000 euros and an average term of 50 months, Santander is the largest private mobility financier in Austria. The number of dealer partners increased to around 1,900 in 2023.

“We expect a difficult year, but we remain optimistic,” emphasizes Mike Schwaiger. Continued inflation, combined with high interest rates and an uncertain global political situation, are dampening shopping sentiment. The Santander CCO expects a decline in values and price wars on the new car market, especially for electric cars. The used car business, on the other hand, is already a few percent higher than last year in the first quarter of this year. Good news for Santander, which is committed to strong penetration of the domestic used car trade. Mike Schwaiger concluded: “Fortunately, despite all the bad news, the Austrians have not lost the fun of driving cars and motorcycles.”

Suche

Suche

Mein Konto

Mein Konto