The car market remains in decline

EU new car registrations are falling by a fifth - no improvement is expected for the time being.

The car market remains in decline

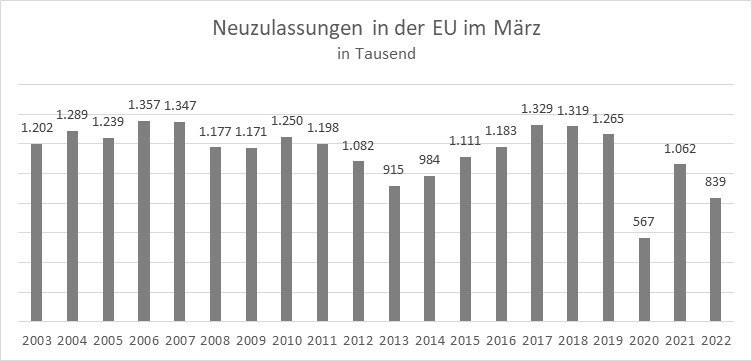

The European new car market is in decline: In March, new car registrations in the EU fell by 21 percent compared to the same month last year, and in Austria by as much as 30 percent. Compared to the pre-pandemic level (March 2019), there is a decrease of 33 percent across the EU and 35 percent in this country. Fewer cars were sold in the EU only in March 2020, at the peak of the first Corona wave.

In addition to the chip crisis, the consequences of the war in Ukraine and the lack of important supplier parts had an impact for the first time in March, according to Axel Preiss, Head of Advanced Manufacturing & Mobility at EY: "The shortage of semiconductors, other intermediate products and raw materials has a massive impact on the ability to deliver for most manufacturers. There is no improvement in sight; the situation could only ease from autumn of this year at the earliest. The establishment of alternative supply chains - for example by using other sources of supply or increasing production at other locations - is "It's time-consuming and can't be achieved overnight. The chip shortage could even have a negative impact on car production until next year. The availability of new cars will not improve for the time being, delivery times will remain longer than average, and prices will continue to rise, especially on the used car market."

The overall difficult conditions, including on the demand side, are currently having little impact, says Preiss: “Rising inflation, faltering economic activity, extremely high fuel prices – all of these factors could have an impact on demand in the medium term, but currently do not play a role for the automotive industry.” According to Preiss, a decline in new registrations in the EU of around ten percent compared to the previous year currently appears realistic: “The EU new car market could fall to a new historic low in 2022.”

The crisis in the supply of important supplier parts is increasingly slowing sales dynamics in the growth market for electrified new cars, especially for plug-in hybrids: sales of electric cars and plug-in hybrids in the five largest markets in Western Europe (Germany, Great Britain, France, Italy and Spain) only rose by seven percent in March compared to the same month of the previous year, after growth of 36 percent had been recorded in February. In Austria, sales of electrified new cars actually fell by 17 percent in March compared to the same month last year.

The growth momentum for plug-in hybrids was particularly slowed down. Sales fell by 18 percent in the top 5 markets in March and by 30 percent in Austria, while purely electric cars recorded an increase of 31 percent (top 5 markets) and a decrease of eleven percent (Austria).

"Sales of electric cars and hybrid models could be significantly higher if the industry was able to deliver. There are even more chips installed in electric cars than in conventional cars, so the chip shortage is hitting the segment particularly hard," observes Preiss.

The market share of electrified new cars (electric and plug-in hybrids together) rose from 15.3 to 20.4 percent in the top 5 markets in March compared to the same month last year. In Austria, the market share climbed from 17.3 to 20.4 percent - despite a decline in new registrations, including in the electric segment.

In March, Great Britain had the highest market share of electrified new cars among the top five markets in Western Europe at 25.6 percent, followed by Great Britain (22.7 percent).

When it comes to purely electric cars, Great Britain was ahead with a share of 16.1 percent in March, while plug-in hybrids were most popular in Germany (market share: 11.3 percent).

Suche

Suche

Mein Konto

Mein Konto