Changing of the guard on the car market: Tesla and the young wild ones

Tesla is just the tip of the iceberg: a leadership change is underway in the auto industry. An analysis shows who the big winners and losers are.

Changing of the guard on the car market: Tesla and the young wild ones

The transformation of the auto industry is in full swing, electrification and digitalization are the buzzwords, companies like Tesla and VW are on everyone's lips. The motor vehicle industry took a closer look and realized that this is just the tip of the iceberg and that some aspects of the change are not yet anchored in the collective consciousness.

The car of the future is significantly different from the car we have known for decades. The automotive industry is therefore undergoing radical change - towards alternative drives, digital networking and more sustainability. Companies like Tesla and VW are in the spotlight. Elon Musk is driving the industry forward technologically; his company has long been by far the most valuable car manufacturer in the world. You can read why this is the case and whether it is justified in this article Analysis of Tesla shares (WKN: 88160R101, ISIN: US88160R1014).

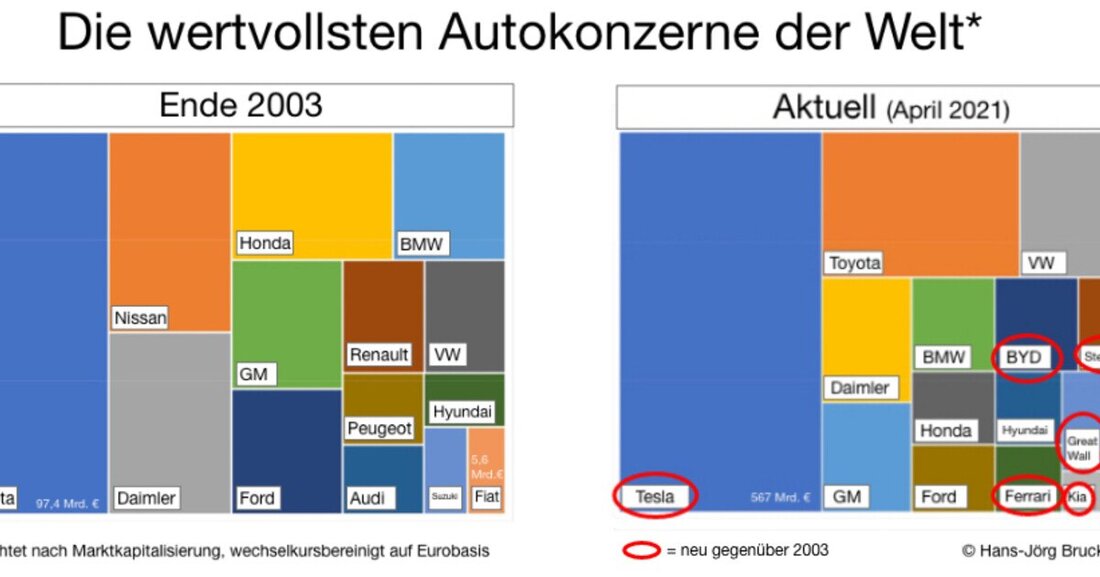

Top dogs like Volkswagen have now jumped on the bandwagon towards e-mobility and are investing billions in their version of the car of the future. This much is common knowledge. The automotive industry wanted to know how the car manufacturer industry was developing overall and researched the market capitalization of the 15 largest car manufacturers in the world to find out how the power structure has changed over the years.

1.47 trillion euros

The good news: The companies in the automotive industry have done excellently despite all the challenges and, it seems, have also overcome the corona crisis well. Shares such as those from Volkswagen (WKN: 766403, ISIN: DE0007664039) or Daimler (WKN: 710000, ISIN: DE0007100000) have already doubled in value since the crisis low in 2020 and some shares have even stalked back to their old highs. At the beginning of the millennium (specifically at the end of 2003), the 15 most valuable car manufacturers in the world were worth around 351 billion euros together; today it is already 1,470 billion euros. So the value has quadrupled.

Of course, it is no longer the same corporations that are fighting for position here. No fewer than seven of the 15 most valuable car companies are new additions (see graphic). First of all, there is Stellantis, the company that emerged from the merger of Fiat and PSA (Peugeot Citroen). This has always happened, with mergers creating new proportions and shaking up such rankings. The latter also applies to IPOs such as that of Ferrari, which took place in 2015, as well as exits such as Audi (which was delisted by VW).

Tesla has overtaken Toyota

The above-mentioned change in leadership at the top is spectacular and well known: From there, Toyota had hailed for decades as almost traditionally the most valuable car manufacturer in the world. In the meantime, Tesla has not only overtaken the Japanese, but has literally left them in the rearview mirror. Tesla is already worth almost three times as much as Toyota. And this is by no means due to a weakness on the part of the Japanese, as Toyota's value has more than doubled compared to 2003. So you could also make a lot of money with this stock.

However, the most spectacular change, which very few people are aware of, is the triumph of Chinese manufacturers. With SAIC, Great Wall and BYD, three Chinese companies are already among the top 15 most valuable car manufacturers in the world. And for good reason: Even if consumers in Europe don't notice much about it yet, China's car manufacturers are in the fast lane.

Chinese are stepping on the gas

The car market there has developed rapidly in recent years. Even now, when the situation in Europe is still tense because of Corona, the Land of Dawn is already experiencing a boom again. China's economy has largely overcome the Covid crisis and has had a brilliant start to the new year: As the Beijing Statistics Office reports, the world's second-largest economy grew by 18.3 percent in the first three months compared to the first quarter of the previous year.

Car sales increased disproportionately: from January to March 2021, around 5.08 million cars were sold in China, an increase of around 75 percent compared to the crisis-ridden previous year. The recovery of the Chinese car market is also pleasing to German manufacturers - even though their dependence on China is also increasing. Of course, Chinese producers have the largest car market in the world, which is also growing rapidly, on their own doorstep. And they are just getting going in the overseas markets - so they still have a lot of growth potential there too. SAIC (Shanghai Automobile Industry Corporation), for example, is currently shaking up the local market with the traditional British brand MG - repositioned as an electric brand.

Battery as a key technology

The Middle Kingdom and its manufacturers are developing very strongly in the area of electromobility. BYD (the abbreviation stands for Build Your Dreams), for example, is the world's largest producer of lithium-ion batteries. In general, the music when it comes to lithium-ion cells is playing despite Tesla's success in Asia. In 2019, according to a market analysis, around 90 percent of the relevant production capacity was accounted for by manufacturers from the Far East, especially Chinese companies such as BYD or the battery manufacturer CATL ( You can find out more about this here ). These companies have long since taken a firm place in the value chain of Western OEMs.

The Center of Automotive Management (CAM) has ranked car manufacturers in the field of electromobility according to their innovative strength (in terms of range, consumption and charging performance). Tesla won ahead of VW. In third place is not Daimler, BMW or Renault, but BYD. There are four Chinese car manufacturers in the top ten of the CAM ranking (in addition to BYD, Geely, BAIC and SAIC), plus the Korean manufacturer Hyundai. But not BMW or Daimler.

The relegated: French and Japanese

Back to our ranking: Electrical expertise obviously seems to be rewarded on the stock market. No wonder, as this is the strongest growth segment. The Chinese company Geely narrowly missed the top 15 and has a market capitalization of the equivalent of a good 20 billion euros, while SAIC and Great Wall Motors even have a good 30 billion euros each. For comparison: Renault, once a fixture in the top ten, currently has a market capitalization of only around ten billion euros. Renault's sister company Nissan and Suzuki have also fallen behind. So a certain decline of the Japanese is also visible: Seven of the 15 most valuable industry representatives are already Asian corporations - but only two of them are still based in Japan.

A recent study by EY shows that the stock market is right, as always. The pandemic led to a collapse in sales and profits in the global auto industry in 2020. The total sales of the 17 largest manufacturers fell by 13 percent, car sales by 16 percent and operating profit by as much as 37 percent. Only four companies were able to show a positive profit development: Tesla, Daimler, GM and Kia. Kia promptly rose to the ranks of the most valuable industry representatives and Tesla has long been number one. Overall, German car manufacturers got through the crisis year comparatively well; French manufacturers were hit harder, with profits plummeting by 84 percent (with a 20 percent decline in sales).

Conclusion

The extent to which the automotive industry is undergoing change is not only reflected in the registration numbers, advertising and press releases from manufacturers. The transformation of the industry and its trends are also visible in the price development on the stock exchanges. The power structure within the auto industry has long been out of control. Chinese manufacturers should no longer be laughed at, but should be taken seriously as competitors.

Suche

Suche

Mein Konto

Mein Konto