Study: The turnaround can succeed

According to the Roland Berger study “Automotive Outlook 2040”, Europe’s automotive industry has a future despite tough competition.

Study: The turnaround can succeed

The global auto industry is undergoing a period of upheaval that will massively change the industry over the next decade and a half. This is shown in the new “Automotive Outlook 2040” from the strategy consulting company Roland Berger. The central factor here is a regional shift in the markets: While new car sales in the global south and China are growing strongly and will together account for around 60 percent of the global market in 2040, the western markets have passed the peak of the car economy. Nevertheless, alongside China, they remain the most important sales market for the industry. Overall, the number of new car sales worldwide will grow by around 1.1 percent per year until 2040. At the same time, electrification continues: around 70 percent of new cars worldwide will be purely electrically powered by 2040. In addition, automation and ever-increasing vehicle networking will shape the industry; software will become more important than hardware. This means that the value chains and sources of income for established manufacturers and suppliers are also changing. Those who set strategic priorities correctly still have good opportunities for growth.

“The global change in the automotive industry is irreversible and will continue to accelerate rapidly in the coming years,” emphasizes automotive expert Gundula Pally, Managing Partner Roland Berger Austria. "This high pace will pose a challenge for many companies. However, pessimism is not appropriate, because the upheaval opens up new opportunities." Four key trends will shape change by 2040: polarization, automation, connectivity and electrification. The polarization is particularly evident in new car sales: In the western markets of Europe, the USA and Canada, the number has reached its peak (“Peak Auto”) and in some cases has already exceeded it. Accordingly, these markets are expected to stagnate or shrink slightly. However, given their size, they still offer significant absolute growth, which Roland Berger experts estimate at 520 billion euros in the period up to 2040. There will be a strong increase in new registrations in China (+1.2 percent per year), India (+4.2 percent per year), South and Central America (+2.4 percent per year) and other countries in the global south.

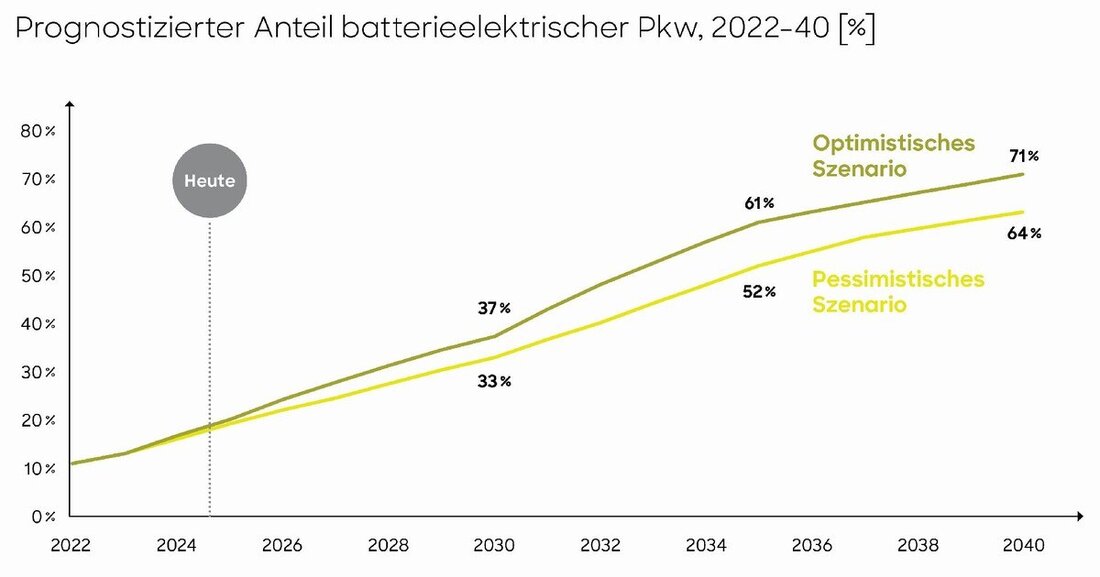

For 2040, the Roland Berger experts assume a BEV share of new cars will be between 64 and 71 percent, depending on the scenario. In addition, 20 percent are hybrids, while hydrogen and synthetic fuels will hardly play a role due to efficiency disadvantages and high costs. Europe should be fully electrified in just over ten years with 99 percent of new registrations being electric if the EU sticks to the current regulations. China passed the 50 percent mark in July 2024 and will reach between 70 and 85 percent by 2040, while the USA will be at 42 to 60 percent and the rest of the world at around 50 percent. “The decline in components for combustion engines will be offset by the growth in electric drives and batteries as well as the increasing demand for electronics as well as components for assistance systems and automation,” explains Gundula Pally.

“We expect the number of European suppliers among the global top 20 to fall from the current seven to five by 2040. The number of Chinese suppliers in this ranking could increase from two to six,” explains Gundula Pally. In this scenario, which is viewed as pessimistic from a Western perspective, the turning point would have been reached in 2040, when Chinese manufacturers would have finally won the race. However, Pally also sees opportunities for a second, more optimistic scenario: Western manufacturers would account for 36 percent of the growth potential by 2040, while Chinese OEMs achieve around 65 percent market share in the domestic market, but only five to ten percent in Europe and less than five percent in North America. “Western OEMs continue to invest heavily in technology and have an established brand image as well as robust networks in production and sales,” said the expert. They should radically rethink their approaches - for example by increasing the use of standardized hardware and third-party software platforms - then they could regain their cost competitiveness and participate in a global marketplace in which all players have equally good opportunities for growth.

Suche

Suche

Mein Konto

Mein Konto