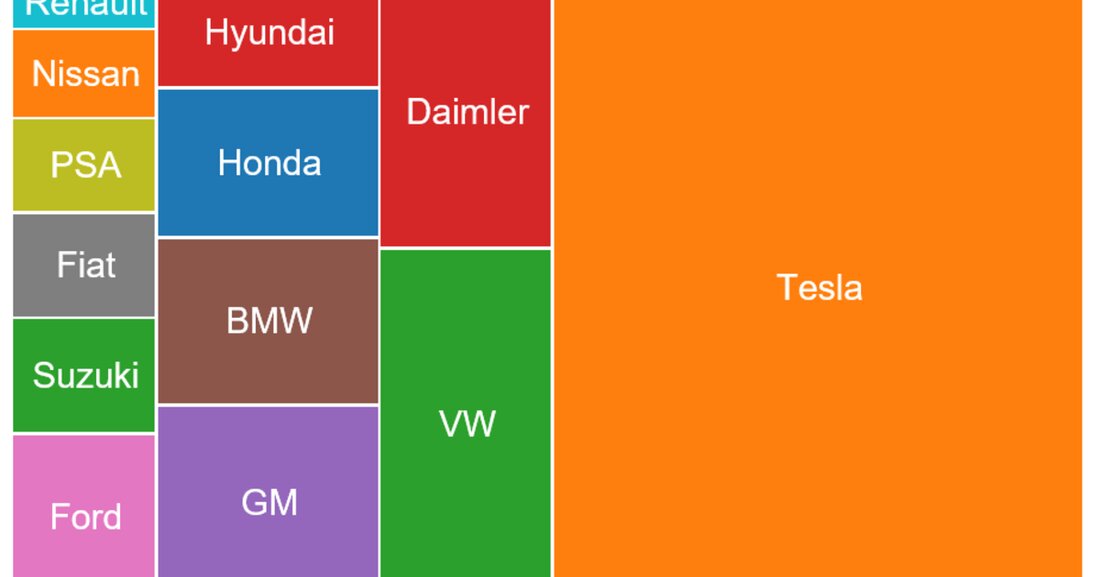

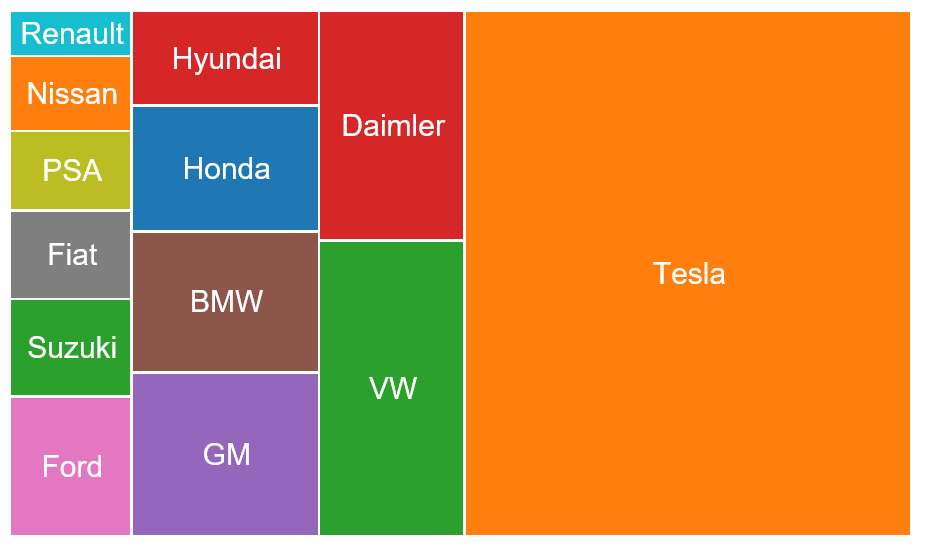

Incredible: Tesla is already worth more than VW, Daimler, BMW...

…GM, Ford, Renault, Peugeot, Fiat, Hyundai, Honda and Nissan together! And that's not the only surprise on the stock market.

Incredible: Tesla is already worth more than VW, Daimler, BMW...

770 percent. The shares of the electric car pioneer Tesla have already gained that much - in just one year. Especially in the year that will go down in economic history as a crisis year of almost epic proportions due to the Corona pandemic. And Tesla of all companies, the company that had serious difficulties not so long ago. Even Tesla boss Elon Musk himself recently announced this. He spoke via Twitter about the fact that the company was only a month away from bankruptcy, particularly because of the Model 3.

The company is now profitable, and Musk can look back on five quarters in a row in the black. In the three months to the end of September, the company achieved a net profit of $331 million (279 million euros) - an increase of 131 percent compared to the same period last year. Sales are also growing rapidly. In the said quarter it climbed by 39 percent to $8.8 billion. And this in an environment in which the car markets as a whole are shrinking (admittedly not the segment that Tesla is betting on).

10,000 percent plus in 10 years

Despite the economic burdens caused by the Corona crisis, the group is sticking to its ambitious goal of delivering half a million vehicles this year. All of this is rewarded on the stock market, and Tesla has long been the most valuable car manufacturer in the world. However, the dimensions are now almost unbelievable: the Tesla Group is now worth a good 600 billion dollars (more than 500 billion euros). Over the course of ten years, the share has increased in value by more than 10,000 (!) percent!

The ratios to the competition are even more impressive: the market capitalization of the proud VW Group is less than 80 billion euros. Daimler is currently worth around 60 billion euros, GM a good 50 billion. In fact, Tesla is currently worth as much as VW, Daimler, BMW, GM, Ford, Renault, Peugeot, Fiat, Hyundai, Honda, Nissan and Suzuki - i.e. 12 large car companies - combined (see graphic)! Toyota, traditionally the most valuable car company in the world before Tesla's rise, is now number two in the industry in these statistics, with a market value of around 180 billion euros - just over a third of Tesla.

Whether this is justified to this extent remains to be seen. Of course, the newcomer's rise to fame was not without reason. While traditional car companies are having difficulties or even slipping, Tesla is on a growth path. In 2019, the US group had sales of almost 25 billion dollars, this year analysts expect an average of around 30 billion, and in 2021 around 45 billion. Net profit is expected to reach the four billion dollar mark in 2021.

VW at a crossroads

For comparison: The three major German providers are likely to have a combined turnover of more than 450 billion this year, in the crisis year of 2020. VW alone had sales of 252.6 billion euros and a net profit of 13.3 billion euros in 2019. This year, of course, a severe drop in profits is inevitable. Like all traditional manufacturers, the group is suffering from general declines in sales on the car market and from the change towards electrification and digitalization. The latter requires investments worth billions, but at the same time the automotive industry is also implementing tough austerity programs with job cuts in the conventional production of vehicles with combustion engines. Penetrating the fleet with new drives is important in order to meet the stricter climate targets. The big question now is whether the transformation will succeed.

At VW, where the steering was turned around late, stock marketers are skeptical that such a large company can master such a radical realignment. The stock is almost 20 percent under water over a 12-month period (the period in which Tesla's value has increased almost sixfold). This means that VW is also one of the biggest flops in the German DAX stock index and - together with its relatives called Porsche - also one of the biggest losers within the European auto industry, including suppliers.

The stock market has already dealt with the crisis

Interestingly, this has long since recovered on the stock exchange, as has the market as a whole. The DAX is already back at the level it was at before the outbreak of the corona crisis, the same applies to the American leading index S&P 500. The US stock exchanges have even just reached new record highs. This generally creates hope that the worst is already over. The stock market always looks ahead and was already in a nosedive at the beginning of the year when the extent of the pandemic was not yet known.

The winners of 2020 include those companies that actually benefit from the various lockdowns: Netflix shares have gained almost 70 percent in value in one year, Amazon 80 percent, Zalando 89 percent and Paypal even more than 100 percent. On the other hand, banks, oil companies and of course companies from the travel industry are among the big losers.

But not car values. Because VW is more the exception than the rule. The Stoxx Europe 600 Automobiles & Parts Index is also already slightly positive over the 12-month period! Tire manufacturer Nokian Renkaat is already 24 percent more expensive than a year ago. But Daimler shares are also up around 17 percent despite the industry crisis and Corona.

Has some takeover fantasy been factored in? Elon Musk has already thought out loud that he could imagine taking over a competitor as long as there was no resistance. Daimler is promptly treated as a possible candidate among US experts. With Mercedes-Benz, Daimler serves a similar customer base to Tesla in terms of price range and demands and could strengthen the Americans' position in the Chinese and European markets.

Key year 2021

In any case, 2021 is likely to be a key year for the industry. Then more new electric car models will come onto the market from German manufacturers than ever before. However, with a view to profitability in the electric car segment, a lot of patience is required. “Toyota, for example, only expects to reach the break-even point with the second generation of electric cars by the end of 2021,” explains Benjardin Gärtner, head of portfolio management for stocks at Union Investment, in an analysis. “According to management statements, only the third generation is likely to deliver a positive margin from 2025 to 2026. The same is likely to apply to German car manufacturers.”

The biggest long-term risk for traditional car manufacturers and therefore also their stocks lies in how the companies manage to switch to electromobility. It won't be easy: the large automobile companies are cumbersome tankers that can only change direction slowly. On the other hand, they usually have plenty of resources and, above all, experience in mass production. Only with large quantities can cost reduction and a profitable business be achieved in the medium term.

Tesla, on the other hand, has a lead as a first mover. Of course, times won't get any easier for the US company now that the competition is stepping on the gas (an admittedly unfortunate play on words when it comes to electric cars). The fact that the share will soon be included in the S6P 500 index is also a double-edged sword: On the one hand, it is a symbol of the rise of the group and in the short term it should also help the share, as fund managers who replicate the index now also have to buy them. On the other hand, the rise also shows one thing: Tesla is no longer a newcomer, but already a big player. And in such cases the growth momentum naturally slows down. Many stocks have already completed most of their journey to success before they receive the accolade of the stock market by being included in major leading indices. Their best times often came before. In any case, the US bank JP Morgan currently considers Tesla shares to be “dramatically overvalued”, which seems entirely understandable given the numbers game presented in this article. One shows how difficult it is to assess the stock and that one can see things differently with overvaluation Analysis of the motor vehicle economy.

Suche

Suche

Mein Konto

Mein Konto