Margin collapse among automotive suppliers

The “Global Automotive Supplier Study 2020” by Roland Berger and US investment bank Lazard shows that the pandemic is increasing the downward spiral of automotive suppliers. With unpleasant details.

Margin collapse among automotive suppliers

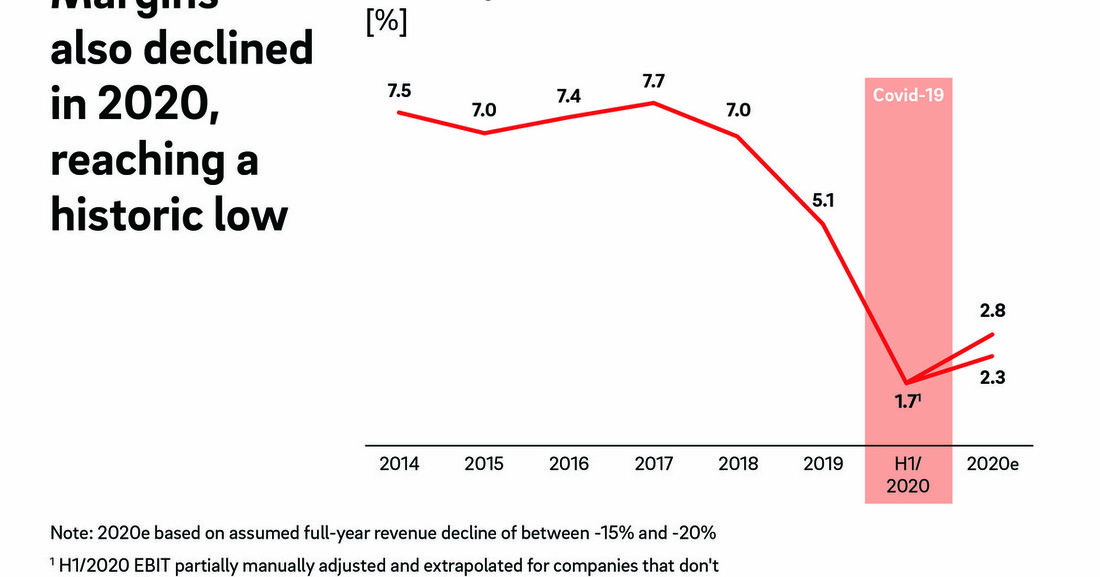

Electromobility, autonomous driving, digitalization: technological change sets theAutomotive suppliers’ profit margins under pressure. At the same time, the corona crisis has further intensified the downward spiral. SobreaktheSalesthis year compared to 2019 globally on averageby 15 to 20 percent.

Theoperating profit marginis in the first half of 2020ononlyFallen 1.7 percent. The results of the “Global Automotive Supplier Study 2020”, which Roland Berger prepared in collaboration with the US investment bank Lazard, show how badly the pandemic is affecting automotive suppliers.For the studyperformance indicators were around600 global suppliers analyzed.

"Despite the difficult general data, there are signs of a positive end to the year. Automotive suppliers can stabilize themselves financially, especially thanks to the rapid catch-up process in China.", saysFelix Mogge, partner at Roland Berger.“However, after the slump, many suppliers lack the capital for the necessary technological transformation.”

Overall, the corona crisis will keep the automotive industry busy for a long time. The highest number of cars sold worldwide is expected to be in 2017 (94.3 million).not reached again until 2026. It will take even longer in Europe and North America, while China and South America are expected to recover more quickly.

Technological change and the effects of the corona pandemic will continue for the foreseeable futureAffecting the margins of automotive suppliers.“The challenges of the coming years will structurally overwhelm many suppliers”, predicts Felix Mogge.“As a result, we will see greater consolidation in the industry.”

In order to be among the winners in this environment, automotive suppliers must strategically develop their business and at the same time significantly reduce costs.

Suche

Suche

Mein Konto

Mein Konto