Eurotax: GW residual values positive signal

Eurotax Austria assesses the coming months in the used car trade. The basic trend is positive.

Eurotax: GW residual values positive signal

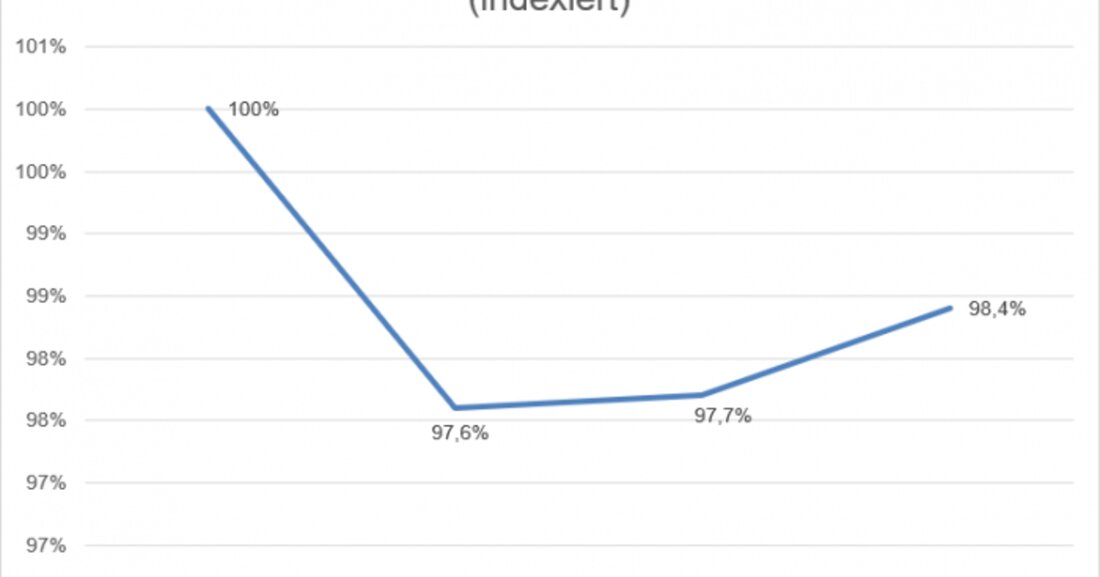

“Our assessment of further residual value developments is currently more optimistic than in the summer”, summarizes Robert Madas, Valuation Insights Manager at Eurotax Austria. The recovery in asking prices on the used car market has continued since mid-May. “Compared to the price level at the beginning of February, the price index in mid-September is on average already above the level before the start of the Corona crisis“, continues Robert Madas.

Although demand on the new car market has collapsed, there was strong demand on the used car market after the end of the lockdown measures, particularly for young used cars. This is also shown by the price development in this age segment: Young used cars up to 6 months old were in great demand and were able to increase in price by an average of 3.0% in the meantime; prices only fell slightly again in August and September. On the other hand, the other age groups have made relatively strong gains in recent weeks.

To assess the impact of the coronavirus pandemic on the automotive industry, Eurotax has examined and updated five possible economic recovery scenarios in terms of their likelihood:

- Low Risk – eine schnelle V-förmige Erholung – 0%

- Low-Medium Risk – mittelmäßig schnelle V-förmige Erholung – 25%

- Medium Risk – langsame, U-förmige Erholung – 60%

- Medium-high Risk – tiefe Rezession, langsame Erholung – 15%

- High Risk – sehr tiefe Rezession, L-förmige Erholung – 0%

“Based on the current market situation, in our view the probability of a ‘slow, U-shaped recovery’ is still the highest at 60%.”said Robert Madas. “However, a moderately fast V-shaped recovery has become slightly larger compared to the previous assessment and we estimate it to have a probability of 25%.”

With regard to the development of residual value, the further development of demand will be decisive. Future purchasing power and economic development in general remain uncertain. Unemployment figures are still high and around 0.5 million people are on short-time work with a loss of income.

“Despite the current recovery in price levels, we still expect a loss in value of around minus 2.5% by December this year compared to the beginning of March.”, continues Robert Madas,“In the medium term, a slow recovery in residual values can be expected.”

Suche

Suche

Mein Konto

Mein Konto