Electric cars are increasingly in demand

Good news: Despite the crisis and global delivery bottlenecks, sales of electric cars in Austria continue to gain momentum.

Electric cars are increasingly in demand

Fully electric new cars achieved a remarkable 13.3% market share in Austria in the first half of 2022 - this corresponds to around 14,500 vehicles and an increase of 1.9 percentage points compared to the previous year. This makes Austria one of the emerging markets when it comes to sales of purely electric vehicles (BEVs).

The current “Electric Vehicle Sales Review” from PwC Autofacts and Strategy& shows that although the growth in global new registrations of purely electric vehicles has slowed due to supply chain problems and lockdowns in China, 61.7% more BEVs were still registered worldwide in the second quarter of 2022 than in the same period last year. In the first quarter of 2022, growth was even 108%. In any case, the market shares of BEVs in Austria and other important markets continue to increase. The top vehicle models on the European market in the first half of 2022 included the FIAT 500 electric (24,649 vehicles sold), Tesla Model 3 (21,023 vehicles) and Renault ZOE (15,580 vehicles).

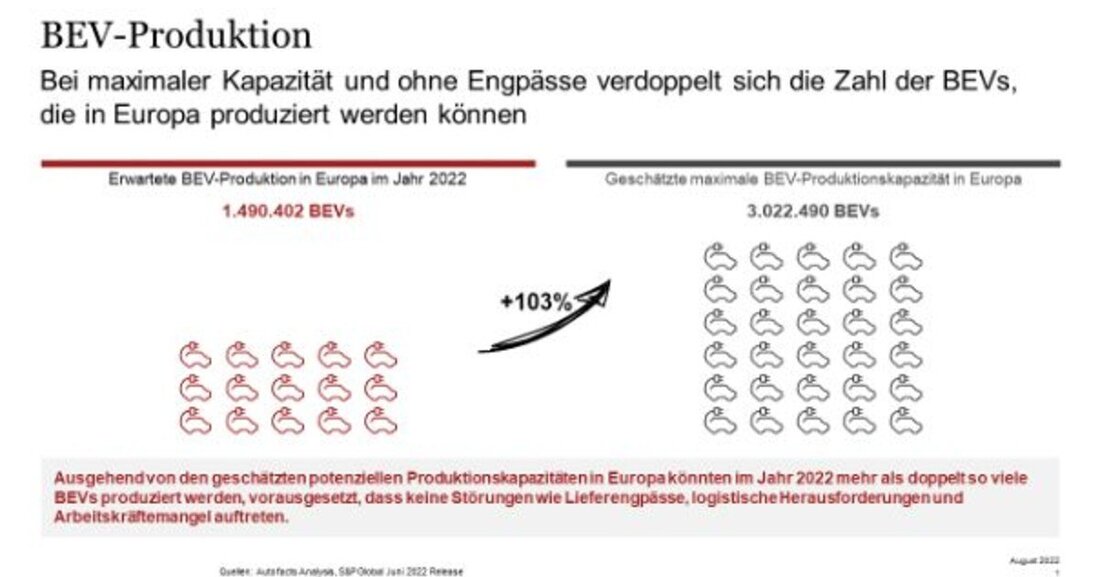

“Electromobility is resisting a stumbling overall market,” says Günther Reiter, Automotive Leader at PwC Austria. “Only just under 1.5 million BEVs will be produced in Europe this year – at maximum capacity and without bottlenecks, there could be more than twice as many.” PwC is already observing the first signs of an easing of supply bottlenecks and expects more production capacity for electric cars with stronger growth in the second half of the year. “For Austria, we expect demand for electric cars to constantly increase in the medium and long term,” says Reiter. In order to better prepare themselves against external shocks in the future, European manufacturers are investing billions of dollars in independent European supply chains, especially for batteries. “We expect battery demand of around 1 TWh and corresponding production capacities in Europe by 2030,” predicts Johannes Schneider, partner at Strategy& Austria. For Europe as a location, it is now primarily about independence: Today, over 60% of the raw materials for batteries come from China and none of the top 20 battery producers come from Europe. The race to open up the European supply chain is in full swing and local, European business potential with primary materials is emerging. “European OEMs should also pay attention to establishing sufficient security of supply for these primary materials,” says Schneider.

Suche

Suche

Mein Konto

Mein Konto