The future of aftersales: Now creativity is required

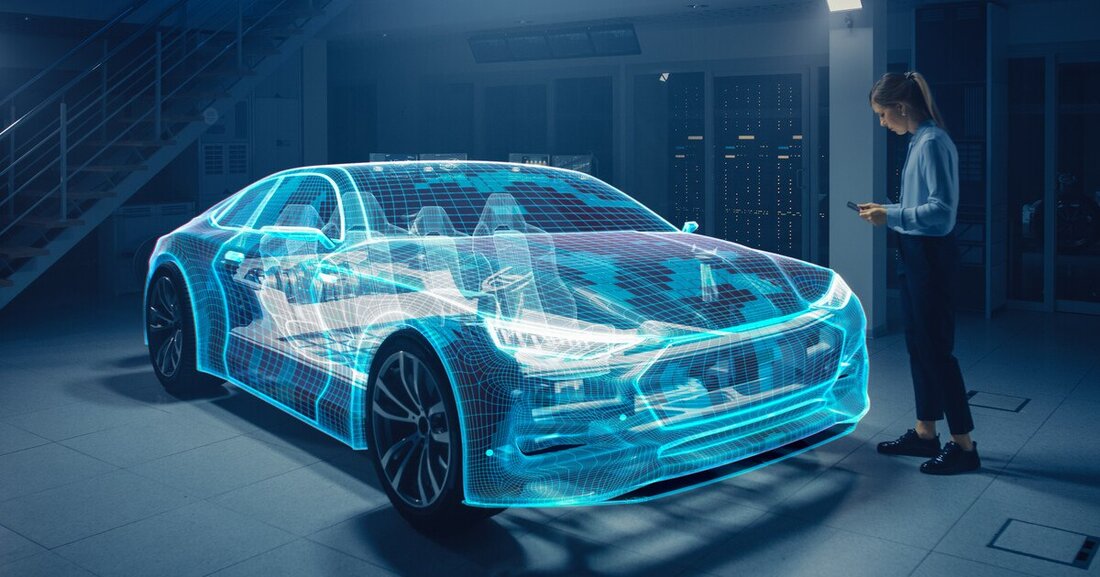

The electrification and digitalization of the automobile can no longer be stopped. This means there is a risk of loss of sales in the aftersales business, which will have to be compensated for elsewhere.

The future of aftersales: Now creativity is required

Even if overall new registrations are still modest, the growth is already considerable: electric cars are in the fast lane. It is not for nothing that VW is investing 35 billion euros in the further development of electromobility over the next five years. The people of Wolfsburg are investing another 27 billion in digitalization. They want to take a leading position not only in terms of the drive, but also in terms of the software in the vehicle and its networking. But what does all of this mean for the future of the aftersales business? Well, basically nothing good. It is all the more important that workshops reorient and position themselves now.

Not a mood maker

By their nature, electric cars are not a mood booster for the industry: they do not require any engine oil and hardly any wear parts, and service sales are correspondingly lower. In fact, market researchers expect declining business.

The good news is that workshop operators still have some time to reposition themselves. At least that's what a current study by market researchers at Bain & Company says. Their forecast up to 2035 refutes the previously widespread view that e-mobility will put a lot of pressure on after-sales business in the coming years. According to the study, the growing spread of electric cars in the five major European markets of Germany, France, Great Britain, Italy and Spain will only lead to a decline in sales of 1.9 percent by 2035. For comparison: Other experts had previously predicted that a 55 percent decline in sales in the aftermarket could be expected over a 15-year period. According to Bain, an overall increase in vehicle inventory will cushion the sales losses caused by new technologies. Only after 2035 will the decline actually become significantly noticeable.

This also applies to driver assistance systems, although these have a stronger negative effect in the short term. The Bain experts expect this to result in a 3.7 percent decline in aftermarket sales by 2035. “The systems currently in use reduce the probability of accidents by up to 30 percent and the severity of accidents by up to 10 percent,” explains Bain partner and study author Eric Zayer. For safety reasons, this is to be welcomed, although the need for repairs and spare parts is significantly reduced.

Here, too, we are only at the beginning of development. This is proven by several studies. In Austria and the rest of Europe, a share of 15 percent of fully automated or autonomous new vehicles is not in sight until 2035, as the “Digital Auto Report 2020” from Strategy&, PwC's global strategy consultancy, shows. In particular, testing the sensors and driving algorithms as well as validating safety represent a challenge for autonomous driving.

The fact that the increasing automation of passenger cars will have a greater impact on the aftersales market in the short term than the electrification of drives is logical insofar as assistance systems are already penetrating the vehicle market to a greater extent. According to Bain, by 2035 two thirds of the vehicles used worldwide will have so-called Level 1 or Level 2 systems that enable assisted or partially automated driving. In addition, there are another 10 to 15 percent of cars that are equipped with Level 3 systems (taking on certain driving tasks).

Silent curse of the assistants

After 2030, the growing number of electric vehicles will have an increasing impact on the overall market. Bain sees car manufacturers and branded car dealerships as the main losers in these market trends. Service companies whose earnings situation is already strained could even find themselves in difficulties that threaten their existence. It is no coincidence that the study is called “Aftersales: The silent curse of driving assistance systems”.

The industry has to adapt to new times anyway. While the aftersales business has grown steadily in the past and was a guarantee of stable income even during the financial crisis of 2008/09, this has changed both quickly and dramatically as a result of the Corona pandemic: During the lockdown in the spring, mileage in Western Europe was reduced by 10 to 15 percent - sales of repairs, maintenance and spare parts will fall accordingly significantly in 2020.

More lockdowns will be added - the effects will become apparent in the next few weeks. The number of newly registered cars was already well below the previous year's level. At the time of going to press, around 28 percent fewer cars were sold in Europe in 2020 than in 2019.

Against this background, experts advise, it is important to adapt structures and costs to the new framework conditions today. This starts with the digitalization of the company. Modern software solutions for car dealerships and workshops can help optimize processes and reduce administrative effort.

Untapped potential

Untapped earnings potential should be tapped and opportunities seized even more consistently than before. The spectrum ranges from insurance and the tire business to support services provided when setting up a private charging infrastructure. “Those who position themselves strategically correctly in the service business with such approaches will free themselves from the silent curse of driving assistance systems better than others,” says the study by Bain & Company.

The charging infrastructure in particular is a huge issue. It must be expanded across Europe in order to achieve comprehensive coverage. Car dealers can do a lot to help in their own interest. A publicly accessible charging station offers car companies concrete advantages: for example, increased customer frequency. It also opens up new sales potential, for example with a small restaurant where the loading guests can get supplies. But the charging station alone is not enough when it comes to making your business fit for electromobility. It is also important to obtain qualifications for maintenance work on high-voltage vehicles. The Automotive Academy, for example, offers training courses for this purpose.

The increasing tire consumption can also partially compensate for the negative effects of electrification: the increased slip during acceleration and recuperation as well as the higher vehicle mass ensure that the tires of electric cars have to be changed more frequently. On top of that, they tend to have larger and therefore more expensive tire dimensions. Car dealerships and workshops can also position themselves here. And finally, car subscriptions are a topic that a car dealership could also take up.

Suche

Suche

Mein Konto

Mein Konto